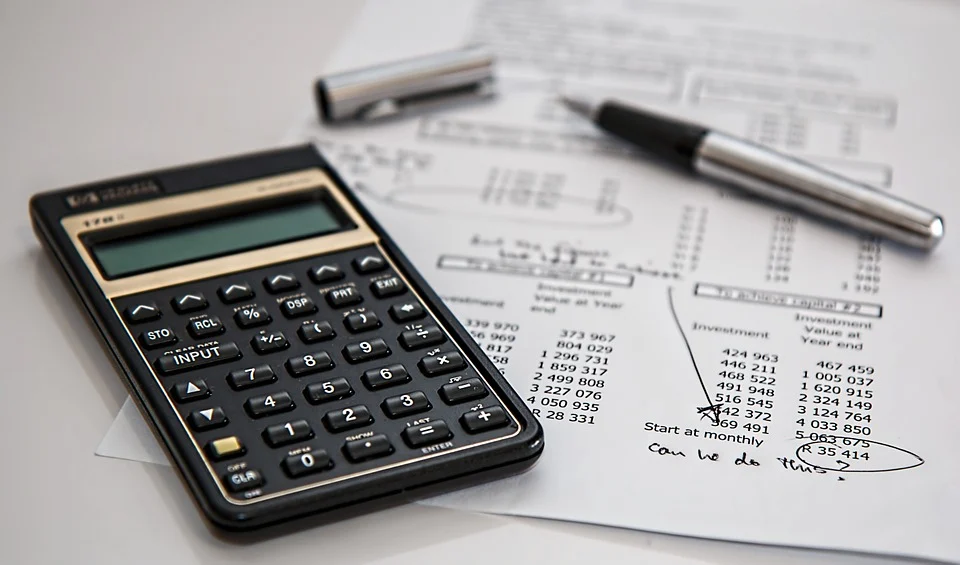

You most often find this type of alliance when a business outsources its financial work to a third party. For example, rather than having a large – and costly – accounting department, a small or medium-sized business will partner with a specialist accounting firm.

A specialist firm will have the experience and skills that can take time to accumulate. If you’re still a growing business, this can be an area that comes with high costs, something you may want to avoid when you’re focusing on your core business. As well as having access to more skilled accountants, it also means that they can offer better cash flow management as well as take care of peripheral financial factors, such as stock programs or pension plans.

5. Technology/IT alliance

As with finances, IT and tech may be an area where you’re cautious about reallocating a major portion of your budget. Yet equally, your business may rely heavily on certain tech or a certain degree of IT provision. After all, nearly every modern business has some reliance on tech, from something as simple as your sales staff being able to make a call from browser to having your email marketing fully automated.

There are companies out there who can cover every aspect of your tech needs, from entire cloud-based communication systems, such as SaaS, to basic maintenance needs for your office computers. As with accounting services, it makes perfect sense to partner with someone who has the necessary skills and can meet your needs without having a negative impact on your budget.

Many entrepreneurs want to focus money and other resources on the core aspects of their business. This can leave a massive hole in their technical ability and provision, something that could have a negative effect on the overall business. As with financial strategic partnerships, you’re partnering with experts in the area you need. It’s a relationship that offers mutual benefits to you both.

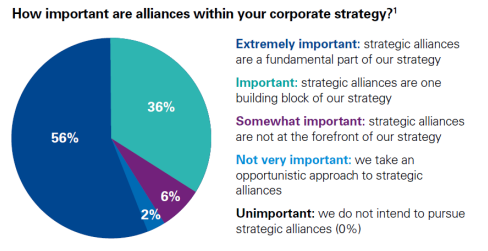

Partnerships summary

There’s a common benefit from all these types of strategic alliances: cost-effectiveness. Even the largest corporation wants to identify areas where they can save money, while for smaller businesses, seeking cost-effective solutions can mean the difference between basic survival and company growth.

However, a prospective partner must be sure that quality is maintained even as they save money. There’s little point in cutting costs if your brand reputation is damaged as a result of partnering with an organization that provides sub-par services or that manufactures low-quality components. You also need to have close discussions on any conflicts that may arise within the partnership, such as the two organizations having different policies and procedures.

Legal alliances

While the strategic alliances we’ve just discussed are ones founded on purely practical reasons, there are also several legal partnerships that can be described as strategic partnerships. While the other types may be formed (in some cases) with informal agreements, legal alliances will have a legally binding agreement that sets out the conditions of such an alliance. The main types of legal alliances you will find include:

1. Joint ventures

A joint venture happens when two (or more) organizations share a common goal or idea that’s best achieved by joining forces. They usually take the form of putting together a separate entity where ownership is shared under an agreed split. A good example of a joint venture is the one undertaken by Uber and Volvo to build a self-driving car that would meet the needs of Uber combined with the safety and reputation of Volvo cars.

2. Equity partnership